Global Selected Fund

The HMCFO Global Selected Fund is an optimal investment portfolio that is “ multi-category, multi-regional and multi-strategy”. It has been established on the basis of the HMCFO Investment Strategies for “Staying Wealthy for Centuries”.

This is a fund traded in the US dollars and investing in the world's excellent funds. The target longterm annual rate of return is 10%. The fund has little fluctuation. It is expected to create a safe harbor for preserving capital value in the global market and offer long-term steady returns regardless of market conditions.

Risk Reduction: The HMCFO Investment Strategies for “Staying Wealthy for Centuries” disperse category risks through diversified investment and spread regional risks through global investment.

Return Increase: The HMCFO Investment Strategies for “Staying Wealthy for Centuries” separate income sources with a financial engineering model that respectively optimizes the β revenue and α income and ultimately builds a top investment portfolio with optimal β and customized α.

The HMCFO Investment Philosophy: The HMC Factor

The HMC Factor is the income-risk ratio, namely, the profit an investor gains for a unit of risk he bears. It is an international common index measuring the performance of a fund against its peers. The HMC Factor indicates the true investment-return rate an institution brings for its clients (the income-risk ratio of a top-ranked global institution being 0.8 and that of a top domestic one being 0.4). With the HMC Factor being the core DNA, the HMCFamily financial engineering model underpins the HMCFO Investment Strategy for “Staying Wealthy for Centuries”, featuring “one risk, two returns”.

With the HMC Factor, the HMCFO solves a challenging problem: Increasing investment yields while reducing risks. Thus, it completely removes any concerns investors may retain after they make an investment.

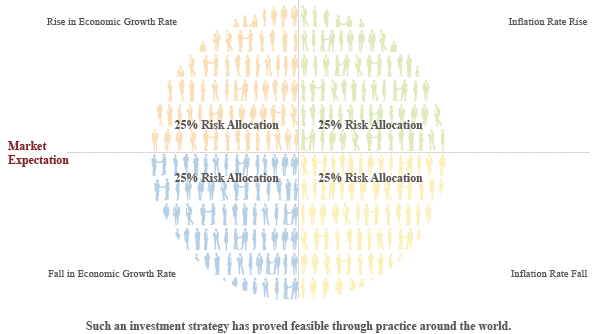

Looking for the Best β Funds

The world’s best β funds selected by the HMCFO Financial Engineering Model allocate the risks brought by rises and falls in economic growth and inflation. Thus, the risks caused by the economic environment offset each other and the risk-premium-corresponding absolute returns remain . The clients can obtain long-term steady yields in any economic environment.

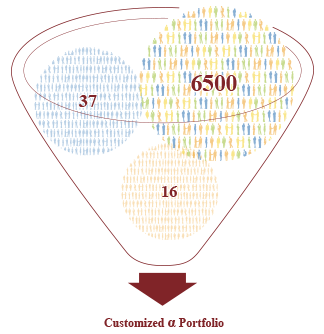

The Construction of Customized α Portfolio

HMCFO selects the best α funds from 6,500 such funds globally to disperse risks. With the accurate calculation offered by the global financial database, HMCFO builds a customized α portfolio based on the best β fund.

The Historical Return of the “Optimal HMCFO Investment Portfolio”

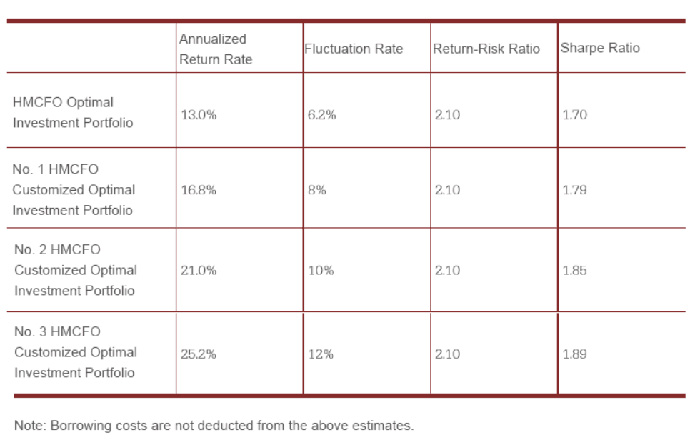

To comprehensively collect the return data of the “Optimal HMCFO Investment Portfolio”, the HMCFO has tracked the portfolio’s yield from January 1996 to January 2021. The cumulative rate of return (the optimal β funds and the customized α portfolio are combined according to their corresponding weight ) is 2219.63%, the annualized return rate being 13.4%, the return fluctuation rate being 6.2% and the income-risk ratio being 2.1%.

(Note: Historical return data from independent valuation and weight construction are used for determining the weight of all the funds in the Optimal HMCFO Investment Portfolio. The customized α portfolio and the weight will change with time.)

According to international standards, the funds with a HMC Factor (income-risk ratio) above 0.8 are excellent financial products. The income-ratio of the Optimal HMCFO Investment Portfolio is 2.1.

The value of the “Optimal HMCFO Investment Portfolio” has been proved through out the Asian financial crisis, the bursting of the dotcom bubble, the 2008 financial crisis and the European sovereign debt crisis, events that had global impacts.

The “Optimal HMCFO Investment Portfolio” with Customized Prospective Yield

In response to specific needs of investors, the HMCFO raised the fluctuation rate of the “Optimal HMCFO Investment Portfolio” to 8%, 10% and 12%. The annualized return rate was respectively 16.8%, 21.0% and 25.2%.

Due to the influence of the HMC Factor, the “Optimal HMCFO Investment Portfolio” can truly realize customized risks and returns. The “Optimal HMCFO Investment Portfolio” , will offer you a customized investment portfolio through adjusting bearable risks to meet your specific investment demands; that is, the target return rate.

Disclaimer: The historical returns in the above portfolio do not represent the future realizable earnings and do not constitute an offer to any institutions or any individuals to subscribe to any financial products from HMCFO.